Sharing is caring!

In our previous FIRE blog we have discussed on the return expectations from stock markets, and we will use that knowledge in planning our asset allocation strategy for retirement. I have also raised few questions also; in this blog we will try to discuss on them.

Table of Contents

ToggleQuestions on FIRE :

1. What if Inflation is higher than expected during your retirement? - FIRE

For Equity Investment: We have discussed how inflation has positive impact on the corporate earnings, that boost the profitability and results in higher returns on our investment.

For Debt Investment:

- Impact on Existing Bonds: If you’re holding fixed-rate debt instruments, such as bonds or fixed deposits, the value of these assets could drop when interest rates rise. This is because newly issued bonds will offer higher interest rates, making your existing bonds less attractive to new investors, causing a fall in their market price. If you’re not selling these bonds, the principal value may not be affected, but your returns could be lower if you were to sell them before maturity.

- Impact on Cash Flows from Fixed Income Investments: For bonds and other debt instruments that pay fixed interest, the cash flow from these investments will remain the same (fixed coupon payments). However, if you’re relying on selling bonds for liquidity, you may face a loss in principal value. If you’re holding them to maturity, your fixed interest payments will continue, but their purchasing power may be eroded due to inflation.

- Inflation Impact on Real Returns: Inflation reduces the purchasing power of the fixed income you receive from debt investments. For example, if inflation rises to 8% and you’re earning 7% on your fixed income investments, you’re effectively losing 1% in real terms, meaning the value of your interest payments will buy you less over time. This is the important concern for retired people to meet daily expenses.

- Bank Fixed Deposits: It usually doesn’t have any impact on existing bank deposits, but at time of renewal, if bank offers higher new fixed deposits its better to exit current deposits and move to new deposits.

- Effect on Real Estate Investments: Due to higher borrowing costs, it slows down the development in the real estate. It could impact negatively on your REITs investments and rental income.

Usually, interest rate risk is higher on the long-term bonds, so, it’s better to invest in low to medium tenure bonds or preferably FD laddering for short terms liquidity. Whenever there is rise in interest rates, we can exit our short-term bond investments or FDs and move to long-term bonds to take advantage of high-interest rate situations.

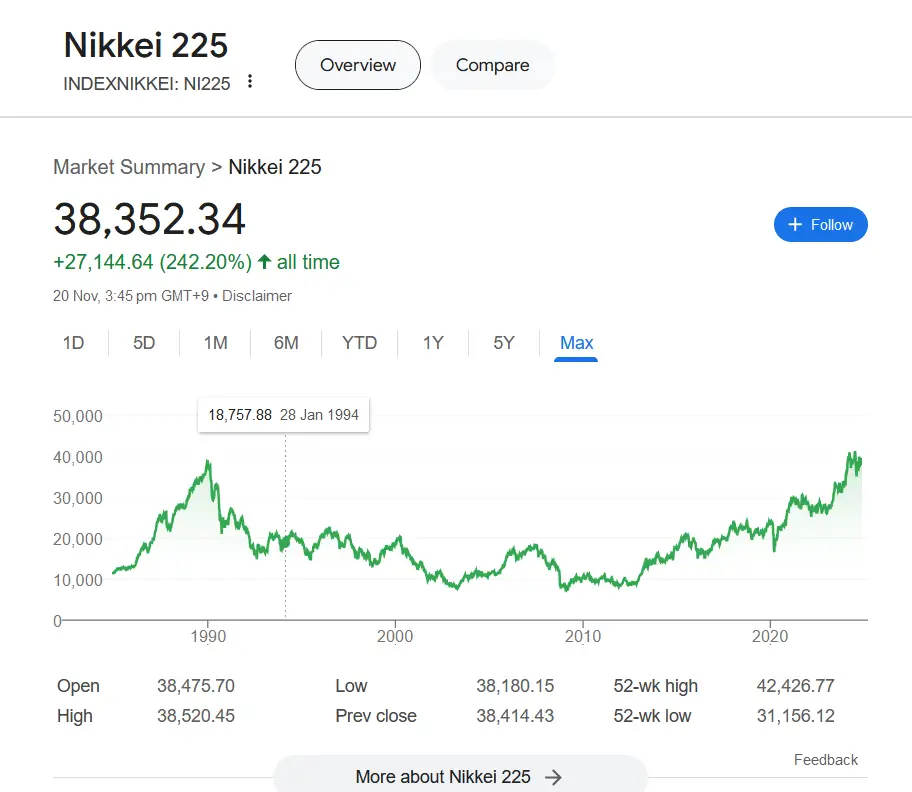

2. What if stock market not performed as expected? Or What if stock market stays sideways like Japan for decades?

With our earlier discussion, you can answer this question by the GDP growth projections given by government, and the existing inflation in the country. In the shorter term less than 5 years, this may not be true we can still experience prolonged sideways markets. but over the long term when GDP is growing and with healthy inflation environment, stock market returns would catch up.

If the government projections for GDP is muted, and inflation in economy is also not growing then it’s a danger sign, and look for rebalancing.

| Year | GDP Growth (%) | Inflation (%) |

|---|---|---|

| 1990 | 5.3 | 3 |

| 1991 | 3.9 | 3 |

| 1992 | 1.1 | 1.7 |

| 1993 | -0.4 | 1.2 |

| 1994 | 0.6 | 0.7 |

| 1995 | -0.2 | 0.1 |

| 1996 | 2 | -0.1 |

| 1997 | 1.1 | -0.4 |

| 1998 | -2.6 | -0.5 |

| 1999 | 0.3 | -0.3 |

| 2000 | 1.9 | 0 |

| 2001 | -0.2 | -0.6 |

| 2002 | 0.1 | -0.1 |

| 2003 | 2.7 | 0.1 |

| 2004 | 2.1 | 0 |

| 2005 | 2.1 | 0.1 |

| 2006 | 1.8 | 0.2 |

| Year | GDP Growth (%) | Inflation (%) |

|---|---|---|

| 2007 | 1.9 | 1.4 |

| 2008 | -1.2 | 0.2 |

| 2009 | -5.2 | -1.2 |

| 2010 | 3.9 | 1 |

| 2011 | -0.9 | 0.4 |

| 2012 | 1.4 | 0.2 |

| 2013 | 1.9 | 0.3 |

| 2014 | 1.5 | 3.3 |

| 2015 | 0.9 | 0.8 |

| 2016 | 1 | 0 |

| 2017 | 1.7 | 0.5 |

| 2018 | 0.9 | 0.9 |

| 2019 | 0.7 | 0.5 |

| 2020 | -4.8 | -0.2 |

| 2021 | 1.7 | 0 |

| 2022 | 1.1 | 2.2 |

If you look at above table, Inflation and GDP growth of the Japan, its at the time of 1993-94, GDP and inflation near to 0 indicating weak economic status of Japan.

If you can see the index chart of Japan (Nikkei 225), As per the GDP and Inflation you can exit the stock investment and replace with other debt allocation.

Challenge here is, the interest rate also around 0 during those times, it means, your debt investments also don’t give any returns. So, you can move your investments into rental assets, or even try international investments.

This way you could have avoided longer distress period investing in stock markets based on GDP growth and inflation numbers.

3. Does the retirement corpus last for 30-40 years long?

Unfortunately, there is no direct answer for this question, it depends on withdrawals percentage of your corpus, and sequence of withdrawal, and number of funds you diversify your retirement corpus.

We will revisit this question again, and discuss in more detail when we discuss on 4% rule and withdrawal strategies and more.

Let us start our discussion on determining FIRE number.

This is different for different persons, as personal finance is personal for everyone. There is no one FIRE number that applicable to everyone.

I will try to discuss the ideology of planning FIRE for an individual and you can take ideas from that and determine your FIRE Journey.

See you all in our next blog.

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

To read more on FIRE please click here for part 1

To read more on FIRE please click here for part 2

To read more on FIRE please click here for part 3

IMAGE Credits : Freepik

Sharing is caring!