Sharing is caring!

You might have heard the phrase that time is money. Have you ever questioned why time is considered money? Before understanding the role of time in your retirement planning or any kind of investment you make there is one thing you need to know. You need to know the value of your time, and how much you can earn with your time.

Understanding your time

Take a minute to assess how you use your time? To chat with friends, chill on Netflix, or spend with family? But most of you have one thing in common you spend most of your time making money. As you know that everyone has limited time, with that limited time how much one can earn?

You need to know how long you may work from now to answer this. For example, you are 30 working 45 hours a week, and you plan to work till you retire at 60. Now you can calculate how many hours you can work for money, which is 70,200 Hours.

You can calculate how many hours you work for till you retire below.

Also, you need to know what is per hour rate, and you also need to know what is your per hour rate to calculate what you can earn with your time.

Per Hour Rate

Your per hour rate is simply the amount you make per hour. The simple formula for calculating your per hour rate is your monthly income divided by the time in hours you worked. For example, if you earn 50,000 Rs per month working 45 hours a week. Your per hour rate is 277.7 Rs.

You can use the calculator below to know your Per Hour Rate.

Now, you know your per hour rate, and you also know how many hours you can work.

For a person who is 30, earning 50,000 Rs working 45 hours a week, with his time he can earn nearly 1.95 Crs working(per hour rate * total working hours).

Note: Your current per hour rate may not be the same throughout your life, your salary may rise in the future and that increase your hourly rate. For the calculation purpose, I didn’t take this salary raise into account.

So finally now you know the value of your time. If you are 30 and earning 50,000 Rs working 45 hours a week, you could potentially earn up to 2Crs working till you retire.

Is that it?

Again, as the phrase goes time is money, is it what they mean? Is your time equal to 2Crs? Not Really.

The value of time is never fixed, It is never 2 Crs, 5Crs, or 100 Crs it depends on the value you add to your life and the quality of the time you spend.

The real meaning of the phrase time is money is complicated to explain because it needs to address emotional and practical aspects. But when it comes to finances time has a great value with the effect called Compounding.

What Is Compounding?

Compounding is the process where you earn interest on the both principal component you invested and also the already accumulated interest component.

How does compounding works?

When you invest, in the 1st year, you get interest on the principal amount, in 2nd year, you get interest on both the principal amount and the interest you got the previous year, and in 3rd year, you get interest on the principal and the accumulated interest from the 1st year and 2nd year, this continues throughout the investment tenure.

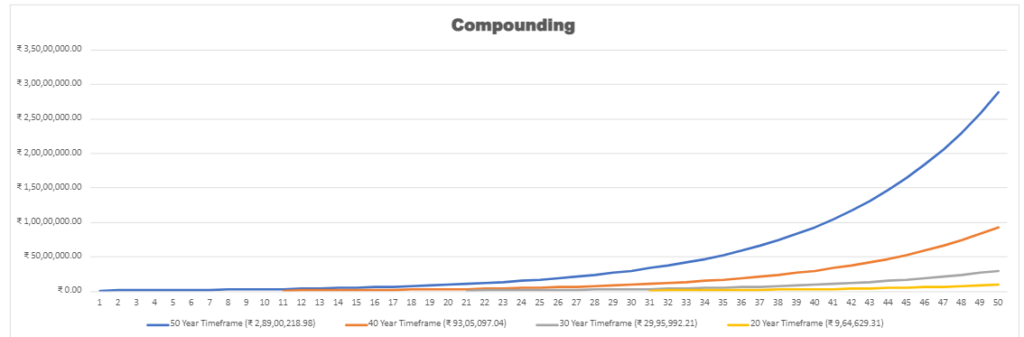

The image above explains it better. Initially, you may not see any considerable growth over time once the interest becomes a sizeable value, your total value grows rapidly.

The image shows how your investment value becomes when you have invested 1,00,000Rs over 50 Years, 40 Years, 30 Years, and 20 Year timeframe. The investment value didn’t change(i.e., 1 Lakh), but time has changed which impacted the overall returns.

When 1 Lakh is invested for 50 Years you get approx 2.8 Crs, the same amount when invested for 40 Years, you get 93 Lakhs only it means your last 10 year period is more valuable than first 40 years, and if invested for 30 years and 20 years you get 30 Lakhs and 9.5 Lakhs.

This is what exactly the phrase time is money means.

Compounding In Action

To understand the effect of compounding in real life, let us take the example of two people Poorna and Chand. Both started earning at age 22, in-hand salary for both is 38,000Rs. Poorna who follows financemadeeasy.in regularly, without blindly following and implementing everything written over financemadeeasy.in, first tries to examine where he stands currently, what works for him, and try to implement by using little common sense and with a mindset of adapting to changes in his life.

The first thing Poorna did was he took a health insurance policy for their parents to financially support and also to protect his family savings in emergencies. Poorna tries to implement the 50:30:20 rule and Emergency Fund discussed here. By which he saves 20% of his income i.e., 7,600 Rs, and also builds an emergency fund. Poorna chooses to invest in an index fund and anticipates a return of 12% CAGR. He invests 5,000 Rs into an index fund and plans to invest the rest of 2,600 Rs to build his emergency fund.

At the same time, Chand believes in YOLO(You Only Live Once) and keep spending on weekend parties, vacations, and gadgets(iPhones, Smartwatch, etc.) at an early age. After a few years, Chand thought of saving for his future. Chand also chooses to invest in an index fund for the same 12% returns when he is 32.

Both plan to invest until the age of 60. As Chand who started investing 10 years late than Poorna, what to invest 10,000 towards his investments.

So here are the calculations.

Poorna is now able to make 3.9 Crs by investing 5,000 Per month. At the same time, Chand starting 10 years late, can make 2.45 Crs even after investing 100% more than Poorna every month. Comparing total investments, Chand has invested nearly 11 Lakhs more than Poorna, but still, Poorna’s final corpus outperformed by nearly 1.5Cr. Therefore, Chand has lost the opportunity to make 1.5Cr more by investing only 5000 Rs, this is the Cost of Delay.

If Chand isn’t decided to invest 100% more and if he had invested 5000Rs only, then Chand can only able to achieve 1.2 Cr instead of what he achieved with 10,000 Rs investing per month which is 2.45 Crs.

Note: Their salary may raise over time, and they can easily able to invest the extra amount for their short-term needs like Vehicle purchases, Home purchases, and other child education expenses. All these expenses are considered short-term compared with their retirement goal, else each of these education expenses and home loan expenses is considered long-term in their terms.

Conclusion

The time, rate of return and the amount you invest are the key parameters that decide your final corpus. Not everyone can able to invest most of their income for their future, so even with a small amount you can create wealth only when you START EARLY.

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

Sharing is caring!

Comments