Sharing is caring!

Ask your parents what are the savings or investments they made. The most common answers are LIC policies, Fixed Deposits, and Public Provident Fund(PPF). PPF is most popular among Indians not only for the reason of the Save Investment product but also offers tax benefits.

One of the earlier posts discussed the comparison between the PPF, EPF, and NPS. Today, let us discuss the Comparision between the PPF(7.1%) returns with Mutual Fund returns(12%). Will the PPF be able to beat the returns of mutual fund returns even though PPF has tax benefits?

Basic Difference between PPF and Mutual Funds

Investing in PPF

Public Provident Fund(PPF) is popularly known for its Tax Exemption. It falls under the Exempt-Exempt-Exempt(EEE) Category. So, the Investment is Tax Expected up to 1.5Lakh Investment every year, the returns gained on the investment is Tax-Free, and also the withdrawal is also Tax-Free. The current PPF interest rate is 7.1%.

Investing in Mutual Fund

There are many kinds of mutual funds, some are debt, hybrid, and equity for different kinds of investors. Coming to mutual funds I am a debt mutual fund investor. And people who want to invest in Indian or overseas(foreign) stocks also invest through equity mutual funds.

Based on the risk taken, the returns of the mutual fund vary. Now, assuming you can make 12% annual returns on mutual funds.

The taxation is different, considering the long-term capital gain(LTCG) of 10% on mutual fund gains for comparison purposes.

Investing in PPF vs Investing in Mutual Funds

For calculation purposes, assuming your current age is 30 and you are going to invest in PPF till the age of 60(retirement). Also, compare the same if you have invested the same amount in a Mutual fund instead of PPF.

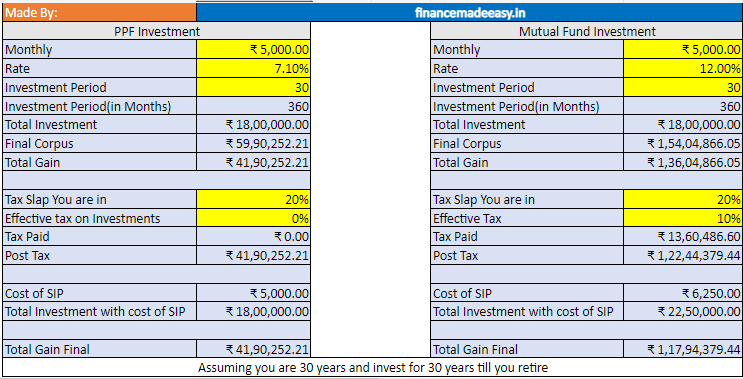

The corpus you achieve by investing in PPF at 7.1% for 30 years with the investment of 5000 Rs every month is 59 Lakhs 90 thousand (refer to Final Corpus in the image below).

At the same time, the investment made to the mutual fund becomes 1.5 Crores (refer to Final Corpus in the image below) at 12% with the same investment of 5000 Rs every month till the same 30 years investment period.

Can you assume this is the final gain for both investments? The gain by investing in a Mutual fund is nearly 1.36 Crores(refer to Total Gain in the below image) which is nearly 3.3x than the PPF returns which are 41.9 lakhs(refer to Total Gain in the below image).

The main advantage of PPF is its tax benefits. Let us consider this tax benefit into account for comparing both products(PPF and Mutual Fund).

Important Breakdown

Tax on the Final Corpus on PPF

Your gain in PPF is 41.9 Lakhs. The tax on the final corpus of PPF is 0%. Irrespective of the tax slap you are in your effective tax on the final value is 0%. So the tax paid on PPF withdrawal is 0 Rs.

Post-tax deduction the leftover final gain is 41.9 Lakhs, with the final corpus including your investment being 50.9 Lakhs.

Tax on the Final Corpus on Mutual Fund

Your gain in Mutual Fund is 1.36 Crores. The tax on the final corpus of the Mutual fund is taken as Long Term Capital Gain of Equity mutual fund which is 10%. So the tax paid on the Mutual Fund returns is 13.6 Lakhs.

Post-tax deduction the leftover final gain is 1.22 Crore, with the final corpus including investment is 1.4 Crores(Investment + Final Post Tax Gain).

Note: this 1.4 Crore is not shown in the excel sheet.

Tax on the investment

There is nothing like the tax on investments. If you invest some amount, the government is not going to collect the tax on your investments.

Does that mean, the final post-tax gain of PPF is 50.9 Lakhs and mutual fund gain is 1.4 Crores?

If you conclude so, you are missing out on the beauty of the PPF product that investments are tax-free.

So how to consider the tax advantage of investment in PPF with other products?

Cost of Investment

Let us understand this concept first.

Imagine your tax slap is 20%, and you now purchase a product/service(mobile, or online services like OTT streaming, etc) worth 50,000 Rs.

What is the amount you spend on that purchase?

Not 50,000 Rs.

Even if you directly pay 50,000 Rs on that purchase you are not paying 50,000.

Now answer how this 50,000 Rs come to you. From your salary. And do you get the total amount as salary without deductions? No.

Even before your salary reaches your bank account, Tax will be deducted.

So to earn 50,000Rs or to have a spending capacity of 50,000 Rs you need to earn 62,500 Rs first and pay 20% tax on your earnings(62,500) which is 12,500 and the leftover balance you will receive(50,000 Rs).

Cost of Investment in PPF

Using the topic discussed above, the cost of your investment for investing 5000 Rs is 5000 Rs itself because PPF is a tax-free investment option too.

Cost of Investment in Mutual Funds

Similarly, the cost of investment into a Mutual Fund for investing the same 5000 Rs is 6250 Rs. So that you earn 6500 Rs first, pay a tax of 1200 Rs and leftover 5000 Rs you invest as an investment in the mutual fund.

So the total cost to you to invest 5000 Rs every month is 22.5 Lakhs(refer to the total cost with investment sip). So that you earn 22.5 Lakhs first and pay a tax of 4.5 Lakhs and the remaining 18 Lakhs is your total investment throughout the total investment period.

Will it always be the case, that every time Mutual Funds provide greater returns than PPF?

The lock-in period for PPF is 15 Years. So now let us also consider the situation where you invest 15 years only instead of 30 years as in the earlier case.

Still, you can see that the potential returns of the mutual funds still outperformed PPF by nearly 2x.

So, always higher the rate of return higher the potential gain in long term.

Just in case you want to know how many years of investment the benchmark that PPF(or any other EEE product) is more beneficial than other products is 8 Years. Due to the tax benefits, if you invest for 8 years or less then only even the low return product gives equally greater returns than high return product.

But the PPF lock-in is 15 years, so the product with higher returns(>8%) has an advantage when compared with PPF.

Note: Investments in mutual funds are never guaranteed returns. Investments are subjected to market risks. Assuming you are gaining 12% annually throughout the investment only for calculation purposes.

The above calculations can be different for different people since earnings, tax, investment, and investment periods can vary. So providing you the excel sheet to fill in your details to calculate with your data.

Conclusion

For any long-term investment goals, when comparing the high return product with low return tax-free product, it is always beneficial to choose high return product since compounding shows its power at a much later time.

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

Sharing is caring!