Sharing is caring!

You may need to take a loan for your expenses. Taking loans is never a bad idea. One may need to take a loan for many reasons to fund their education or fund their vacation, or at least most take loans to fund their emergency unplanned expenses. Many people took loans when they lost their employment during covid, and most of them end up taking a loan for their daily expenses.

Of course, the Government also supported people to take loans this time, But every time you lose your job anyone may not help you. This is the reason why you need an emergency fund.

Now the discussion is not about saving for emergencies, but when required how to take loans with a low-interest rate.

What is the interest rate?

Money is in everyone’s interest. When you need money, someone you know or a Bank will offer you that money. But none of them give you money without any return expectation. You will pay some extra money to them when you return the money you took from them and this extra money is called interest and the rate in percentage terms which is charged for the amount you took is called the interest rate.

For example, if you took 10,000 and when you repay them with 10,100, the extra 100 is called interest and the interest rate is 1%.

List of Few Retail Loans

Before finding how to get loans at low interest rates, you need to know what are the types of loans available in the market. For the sake of simplicity and transparency, taking banks and their loan offerings into account.

Here is the list of types of loans provided to Retail People:

By the above image, Lenders are given most of the loans towards housing loans. Did you see some insights of Indian lenders?

What are the interest rates available in the market?

Most Banks and Lenders are giving loans to homes. But why? Is it random that most of the money banks give is towards home loans?

No.

The logic here is, that the bank treats this loan as a secured loan. So that in case, if you (the borrower) failed to repay the loan, then they can claim your house property and sell the property to recover their loan amount. And Home loan interest is usually considered one of the lowest interest rates loans.

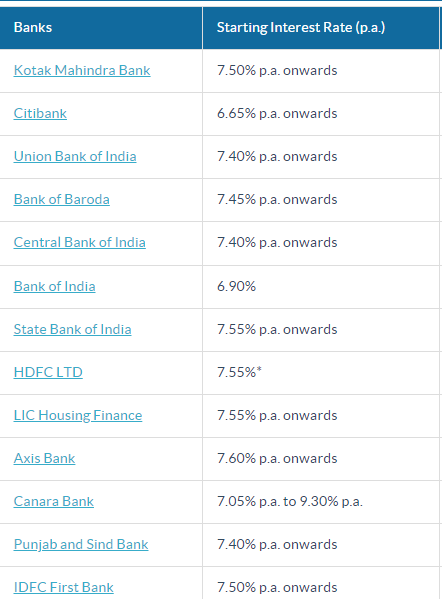

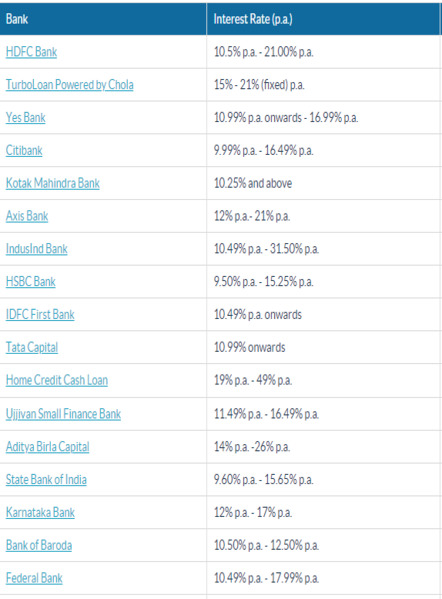

And here is the image of Interest rates various banks offers for a home loan. At the same time consider the loan interest rates of the personal loan in the below image.

On the other hand, there are credit card loans whose interest rates are much higher. These loans are unsecured hence the interest rate is higher.

Now you understand the main concept of how the interest rates are decided. With this, you know how to get low-interest rates loans.

Whenever the borrower knows your repayment strength he offers a loan and when you give any property as surety towards the loan he offers the same loan at a lower interest rate.

Some Low-Interest rate loans you can choose

1. Home Loan

As discussed above, home loans are considered secured loans by banks so they offer low-interest rates.

This is not only the reason. But a Home or the Land you have is an asset for you. So these asserted values most probably increase over time as well. So, even when you come into a situation where you can’t repay your loan so the bank can simply sell your property to recover the loan. Hence, you get cheap interest rates for Home Loan.

2. Gold Loan

People own gold in one or other form in India. Indian households have nearly 25 thousand tonnes of gold, and middle-income people have nearly 56% of the total Indian gold assets.

Gold is an asset and highly liquid(easily convertible to cash). For some short-term needs or for kids’ education you can get an easy gold loan at low-interest rates.

3. PPF Loan ( Popularly known as 1% loan)

If you have PPF savings, it is a good time to know you can get an easy loan against your PPF balance(up to 25% of balance) at an effective 1% interest rate.

If you have a PPF balance of 8 Lakhs, you get a loan up to 2 Lakhs and the interest rate is 8.1%. And you get 7.1% as interest towards your 2 Lakhs. So effectively your loan only attracts 1% interest.

4. Loan against Fixed Deposit

If you have a Fixed Deposit in any bank, you can also get a loan on that FD. Just similar to a PPF loan, you can get a loan against your FD at 2% higher than your FD interest rate.

If your FD interest rate is 6%, you will get the loan at an interest rate of 8%. Hence the effective interest rate is 2%.

Also, there are other loans called loans against property and loans against securities (mutual funds and stocks).

Conclusion

You can observe that all the loans that can help you get at a low-interest rate are different kinds of loans against property(securities/assets).

During the loan tenure, your property/asset is expected to grow in value at the same time you pay the interest to the bank(lender), and the effective interest rate is the difference between the growth of your property/asset and the interest rate that is being charged by the bank.

Finally, for example, if you take a loan at 6% and if you had tried to identify an opportunity and can make 10% on that amount, then you are making money by taking that loan.

For further reading on how to clear your loans quickly, and if you have too many loans and are feeling stuck with their EMI consider reading: Debt Repayment

Media Credits

Interest Loans Images: BankBazaar

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

Sharing is caring!