Sharing is caring!

Most companies are expressing their views on growing India’s earnings potential in their annual reports. India itself is on a growth trajectory and ultimately every sector that contributes to Indian GDP will continue to grow.

Earning the first one crore is still a dream for most people. And Mindset is the most important part of your one crore journey.

MIDSET

When coming to finances, you can categorize the mindset of people dealing with finances as two:

- Fixed Mindset

- Growth Mindset

Fixed mindset

A fixed mindset means people who follow conservative methods to save their money. Conservative means, sticking to the old traditional ways of saving money through LIC Policies, Fixed Deposits, and Gold.

Those people are smart because it worked in the past. In the past, the Fixed Deposit interest rates, and LIC Policy rates of return is higher than inflation.

But for now, the inflation is much higher than the Bank FD rates, and LIC policy returns.

And Gold being Gold is still a very valuable asset and whether your mindset is fixed or growing you will still need to have gold in your portfolio.

Growth Mindset

People with a growth mindset can clearly understand that the traditional ways of saving money will no longer work in this high inflation situation.

People choose to invest their money instead of saving. They invest in Business, Land(Real Estate), Stocks/Mutual Funds, etc.

This growth mindset is very important when you wish to grow your money but it always comes with risk.

You may take risk of investing in business, stocks, or land. But are you capable of taking that risk? Taking risks is not everyone’s game. But being with a growth mindset you always find a solution to mitigate that risk.

EMERGENCY FUND IMPROVES YOUR RISK ABILITY

Everyone might know that Emergency Fund will help you to cover all your expenses for maybe 6 months to 12 months when there is a pay loss or for any emergency. But there is a great advantage of having an emergency fund. IT IMPROVES YOUR RISK-TAKING ABILITY.

By having an emergency fund, you have already covered all your expenses for 12 months. So you don’t need to save for 12 months, no need to worry for 12 months. That eliminates the risk of taking decisions in urgency and you have time to think and execute.

Recipe for Making the first one crore

Age is also an important factor, and it doesn’t mean if you start late you can’t succeed. Why age is important is that with age your risk-taking ability is reduced. You can’t take risks with your money when you are old as you can do when you are young.

And this ability to take risks being reduced with age, will not align properly with the Growth Mindset. There are some exceptional cases that this won’t stop you. Because your growth mindset will always find a way.

RECIPIE = AGE + EMERGENCY FUND + GROWTH MINDSET

Let us begin.

1. Focus on Income

Imagine, you are earning 100 Rs. How much can you save in that 100Rs? 70Rs, 50Rs, or 20Rs? Well even if you have no expenses at all, at max you can only save 100Rs.

Let me suggest you something, why don’t you spend some part of that 100Rs towards increasing your earning potential? Why don’t you spend on learning some skills with some part of your current earnings? People with skills have high demand. Corporates are looking for skills.

Skills always pay. The more you earn, the more you can save or invest. The Key is FOCUS ON INCOME.

2. Start a Side Hussle or Business

Salary is a drug. No one has ever become rich by having only a salary as their income. You may work for your company for 8 or 9 hours a day. If you can spend at least an hour for yourself, for your passion, for your interest you can easily have enough time to work on your projects.

If you love to ride you can offer pickup and delivery service to people(Zomato or Uber), don’t underestimate it, I have seen people who ride for Uber for 2 hours or 3 hours a day after their day job, If you want to learn music you can work, create your album and publish, If you want to run a local fast food franchise there is a lot of market for your business.

By doing so, you are not dependent on your salary alone. You are working for yourself too.

3. Monetize Your Skill With Technology

By working on a side hustle, you need to work actively. To generate a passive income source you can use Technology to Monetize your skill.

If you are a coder, you can write code and sell it online for students. If you know about any topic, you can write an ebook, it is very easy than you think, write in google docs, and upload it to amazon. Don’t forget to provide value through your book. If you know about a tool or technology create a course, or can use youtube to share your content.

Oxford Economics report: Indian YouTubers contributed more than 6800 Crores and in India, 60% of youtube channels who are having 1 Lakh subscribers are earning 1 Lakh per month.

You just create content once and it earns while you are sleeping for years.

4. investing

You need to understand that you can’t do everything. Because you might not be designed for that.

If you can’t make another google why don’t you own some part of google? It can be done by investing. By investing you can make the brilliant brains in the industry with experience are working for you.

Investing itself is a vast subject. Will discuss this in future blog posts in layman language.

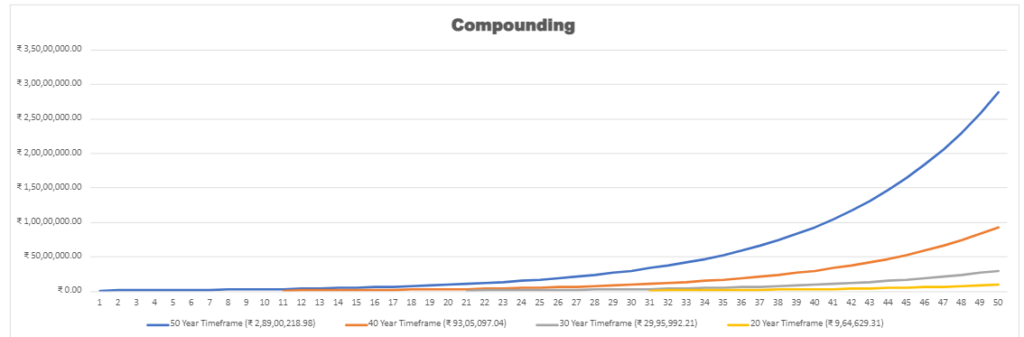

There is a rule about investing, which says if can invest 15,000 Rs and can make 15% per annum for 15 years you can earn 1Crore.

5. Trading

Many people are living on the trading income. It may or may not work for you but this is a career you need to try. There are many ways to trade, buy low sell high, sell high buy low, and also speculate with Future and Options.

Trading requires capital and skills, and the mindset to accept the losses and learn from them.

There is a theory on Trading that will make you succeed called 1% per month.

If you can make 1% per month on your capital, you are making more returns than bank FDs, and Bonds.

1% every month will come to 12% annual returns.

Disclaimer: To be successful in trading, you need skills, time management, and experience. As a beginner, you can’t expect profits. Just learn through the process. If it is not working for you be intelligent enough to leave. Only 1% of people are successful in trading.

6. Real Estate

Any person ever becomes rich either by running a business, by investing in stocks and businesses, or by Real Estate.

The land is an appreciating property. So Real Estate is a successful business but comes with risk.

Not everyone is fit for real estate as it has a high capital requirement. So there is an alternate investment option to invest in real estate with low ticket size(low capital) calls as REITs.

Real Estate Investment Trust(REIT) collects money from small investors and invests in Commercial Real Estate properties. And the rental income that comes from the real estate properties is directly credited into your bank account.

Disclaimer: It is a high-risk investment option. Consult a financial advisor before you invest.

7. EPF, PPF and NPS

All the above-discussed investment options are risky and volatile in short term, and the rest need your efforts and energy. So if you are a normal salaried person, and if you are comfortable and want to spend time with family. You may not like all the above-discussed approaches.

But still, there are government-backed investment products that offer safety and fixed income that will also help you build wealth over the long term.

EPF, PPF, and NPS are the retirement products for Indian backed by government organizations. They offer fixed safe risk-free returns, and tax benefits as well.

EPF offers an 8.1% Interest rate, PPF offers 7.1% and NPS is a market-linked product and usual long-term returns may vary between 10% to 12%.

Refer to this blog for more on PPF, and NPS: While having EPF do you need to invest in NPS even after investing in PPF for 15 years?

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

Sharing is caring!