Sharing is caring!

In the previous post, you learned about the personal finance rules where the main focus is on your income and its split. In this post, you will get to know about the rules related to your investments. These rules suggest how much you invest in equities, gold, and bonds. How long do your investments take to double, triple, or even Quadruple? Interestingly how long it takes for your money to half.

Rule 1: Rule of 72

This rule of 72 tells an investor how long it takes to double the money.

For Example, If you invest Rs. 10,000, in a bond with an interest rate(coupon rate is bond market terminology) of 6%. Then divide 72 by the interest rate gives the time(in years) for doubling your money.

Here, 72/6, which says, it takes 12 years to double your money.

And also, if someone sells you a policy calming that in 15 years your money is doubled, with this rule you can know at what interest rate you are investing.

For example, let us assume the same invested amount of 10,000 and determine the interest rate.

72/15(No of years), which tells the effective interest rate is 4.8%.

With this, now you know whether to skip that policy or purchase that policy.

Rule 2: Rule of 114 and 144

These two rules, Rule of 114 and Rule of 144 tell about how long it takes your money to triple and Quadruple respectively.

For Example, You invested 10,000 at a rate of interest of 8%.

Rule of 114 says 114/8 = 14.25 (14 Years and 3 Months) to triple your money.

Rule of 144 says 144/8 = 18 Years to Quadruple(4x times) your money.

Rule 3: Rule of 70 (Inflation impact on money)

Taking inflation into account, this rule tells when will be the value of your money is halved.

For example, if the inflation is around 6.5%, then every year the value of your money is reduced at a rate of 6.5%, and how long does it take for the value of your money to become half of the value of today given by this rule.

Taking inflation into account, this rule tells when will be the value of your money is halved.

For example, if the inflation is around 6.5%, then every year the value of your money is reduced at a rate of 6.5%, and how long does it take for the value of your money to become half of the value of today given by this rule.

Rule 4: Equity Allocation Rule ( 100 - Age)

This rule is for Equity Investors. You cannot invest all your money in Equities(Stock Markets/Mutual Funds) due to the inherent volatility and risks of Equity Markets. So how much of your money can you invest in Equity? This rules address this question.

You should only invest 100 – Your Age in Equities. For example, if your age is 30, then you should invest a max of 70% into Equity Markets. Based on your risk appetite you may invest 100% into equities but it is always suggested to follow this rule for safety and to face the volatility of Equity Markets.

Rule 5: 10 - 5 - 3

This is an important rule you should understand. This rule is about the return expectation for the assert class you invested in or planning to invest in.

This rule suggests the return expectation for Equity should be 10%.

This rule suggests the return expectation for Bonds should be 5%.

This rule suggests the return expectation for Cash or debt funds should be 3%.

There are changes that over the long term you may gain even more, but while planning for your investment it is advisable to use these return rates of asset classes so that you can easily achieve what you are planning for.

For example, if you are planning to invest in equities for 15 years, and if you assume returns of 12%, even it is quite possible but what if due to any crash or any normal correction in markets reduces your overall returns? You may end up having less amount than you planned for.

So if you have assumed a return rate of 10%, you would have easily planned for your required amount, if you feel like you cannot achieve the required amount within 15 years period with 10% returns you can invest more every month to achieve your goal or at least increase your investment period so you will never end up planning less than the required amount.

Use this rule along with the rule of 72, to understand better how long different assert classes take to double your money. Equities take 7.2 Years to double your money, Bonds take 14.4 Years to double your money, and Cash Investments(Liquid Mutual Funds/Savings Accounts) take 24 years to double your money.

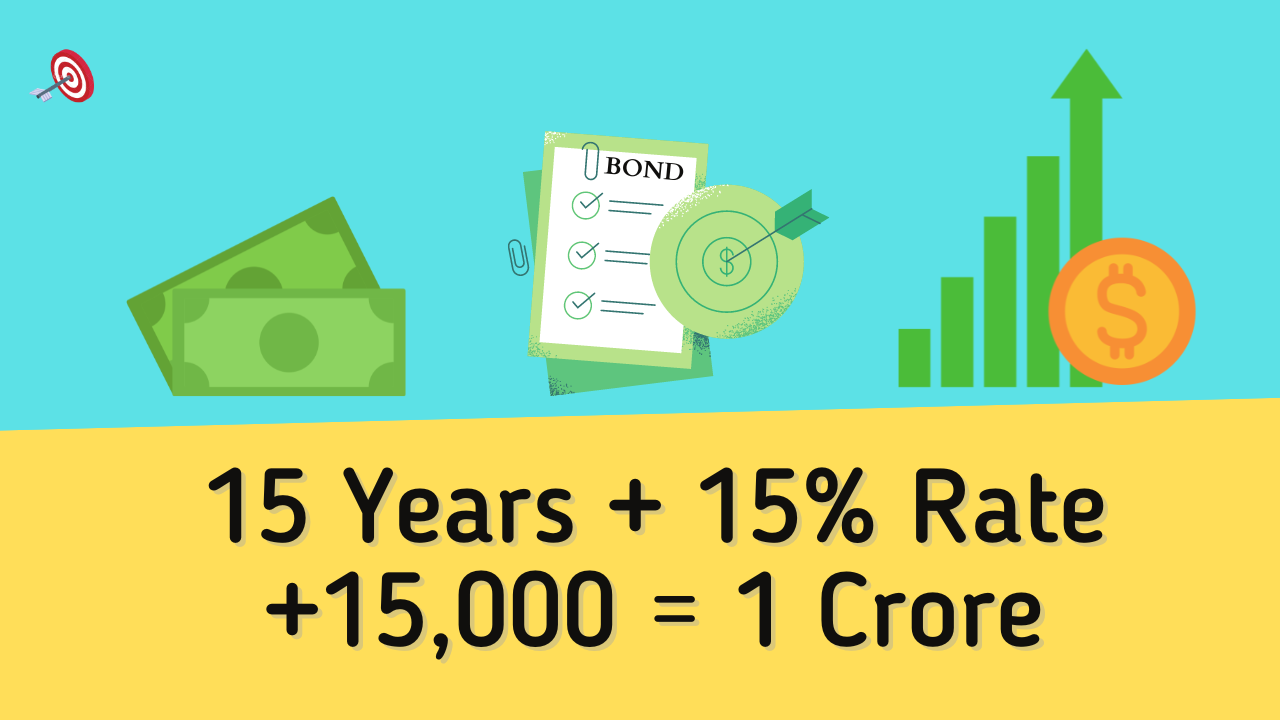

Rule 6: 15 -15 -15

Kaun Banega Crorepati? Everyone wants to be Crorepati. And this rule will let you know how?

This rule says that if you can invest 15,000 every month and manage to generate a return of 15% per annum and if you do that for 15 years you will earn 1 Crore.

Please note, this rule doesn’t say about any assert class in specific. It just says about your overall portfolio.

For Example, if you invest in gold at 8.5% returns, and in Real Estate at 11%, and invest in high-risk small caps to generate 20% – 22%. So overall if you manage to get around 15% returns for 15 years while investing 15,000 you will become a Crorepati.

Rule 7: 4% Withdrawal Rule:

Throughout your work life, you follow rules for your investing and savings for better money management, post-retirement those rules may not help you because at this age protecting money is more important than growing money.

After your retirement how will you spend your money? Do you go on vacation every month and overspend?

This 4% rule is one such rule that helps you post-retirement. This rule suggests the retired person should take 4% of the total retirement corpus per year for living expenses and invest the rest.

You can take better advantage of this rule when you use it while planning for your retirement. You will learn this in the retirement planning series. If you are a young professional you need to plan for your retirement ASAP, because time will work positively for you.

Media Credits

Image 1: Bull Market | Stock Market

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

Sharing is caring!

Comments